capital gains tax budget news

Capital gains tax will continue to apply to Aussies crypto investments as confirmed by an explicit mention of digital currencies in the federal budget. To discuss Capital Gains Tax Capital Acquisitions tax and your business contact Mike Scanlan Senior Tax Manager on 01 6440100.

Biden Focuses On Capital Gains Taxes As He Seeks Money For Social Programs Wsj

Another 10 per cent of wealthy Canadians paid up to 15 per cent which is essentially the first income tax bracket for the federal government.

. But if you sell a debt mutual fund the threshold. On May 28 th Bidens budget revealed plans to raise the marginal income tax rate up from 37 to 396. 21 2022 608 pm ET.

On top of this the administration is aiming to increase the long-term. October 26 2022 859 PM 1 min read. The Budget in March announced the reduction in the rate of tax payable on capital gains.

This spread has led many taxpayers to deliberately create capital gains as a form of remuneration from their company. Growth Plan 2022 Or. If you buy a listed bond then you pay long-term capital gains LTCG tax of 10 percent if you hold it for more than 12 months.

On April 7 2022 the Federal Budget will be released. Paul Gigot interviews Rep. Capital Gains Tax News Latest news on Capital Gains Tax in the United States where individuals and corporations pay US federal income tax on the net total of all their capital gains.

Following a simplification review Capital Gains Tax CGT is an area that we have been expecting to hear some major announcements in but the Chancellor decided to leave. Legal challenges to the capital gains tax were filed during the summer of 2021 shortly after the tax was enacted by the Legislature during the 2021 legislative session. 1 2022 with the first tax payments due April 15 2023.

For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. By Naomi Jagoda - 072421 500 PM ET. Lynda Wilson R-Vancouver released a statement on Tuesday that raised questions about the state Department.

The capital gains tax would go into effect Jan. Capital gains taxes on assets held for a year or less correspond to ordinary income tax. Republicans waging war against President Bidens proposed tax increases are increasingly focusing their opposition on one.

3 hours agoThe capital gains tax approved by state lawmakers has been brought before the Washington State Supreme Court and the state Senate Republican budget leader has. In the waning days of. Kevin Brady on the politics of inflation.

If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or 20 long-term capital gains tax rate. Entrepreneurs relief was slashed last. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Its could bring in 11 billion in new revenue in the next biennium and a. RBK will be holding. The Chancellor in his Budget today delivered welcome news to individuals facing a capital gains tax liability following the sale of UK residential property.

Capital Gains Cuts Won T Cure The Covid 19 Economy Tax Policy Center

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Do Capital Gains Tax Increases Reduce Revenue Committee For Economic Development Of The Conference Board

The States With The Highest Capital Gains Tax Rates The Motley Fool

The Administration S Pitch To Lower Capital Gains Taxes Is Another Trickle Down Sales Job Designed To Deliver A Fat Pay Packet To Its Donors The Washington Post

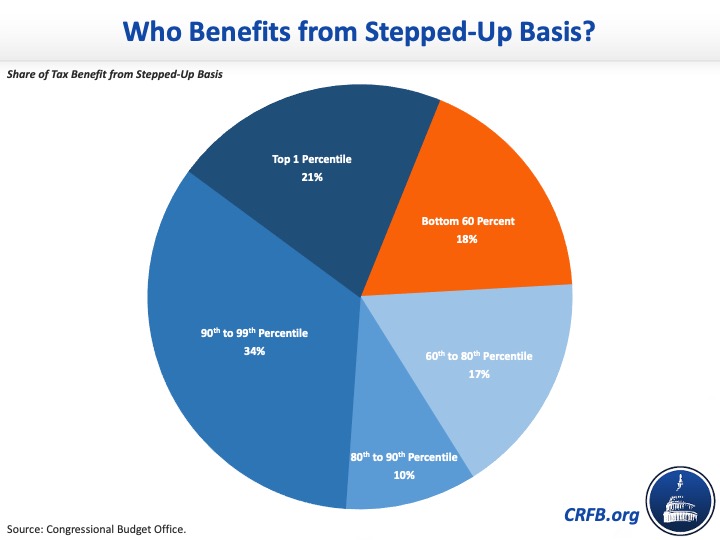

Closing The Stepped Up Basis Loophole Committee For A Responsible Federal Budget

Here S Where The Money To Pay For Biden S Budget Bill Will Come From Capital Gains Tax Budgeting Tax Deductions

Biden S Better Plan To Tax The Rich Wsj

Biden To Include Minimum Tax On Billionaires In Budget Proposal The New York Times

How To Know If You Have To Pay Capital Gains Tax Experian

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Guardian Financial Page Newspaper Headline Article 12 November 2020 Capital Gains Tax Overhaul Could Raise 14bn Review In London England Uk Stock Photo Alamy

Capital Gains Tax In The United States Wikipedia

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Propublica Shows How Little The Wealthiest Pay In Taxes Policymakers Should Respond Accordingly Center On Budget And Policy Priorities

Budget Taxes Archives Page 4 Of 6 Peter Abbarno

Biden S Foolish Capital Gains Tax Increase The Hill

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center